how to check unemployment tax refund on turbotax

You Can Do a Status Check. However if you mail a paper copy of your tax return the IRS recommends that you wait three weeks before you begin checking your refund status.

Video Unemployment And Taxes Explained Turbotax Tax Tips Videos

When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early.

. Will display the status of your refund usually on the most recent tax year refund we have on file for you. 24 hours after e-filing. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next several months.

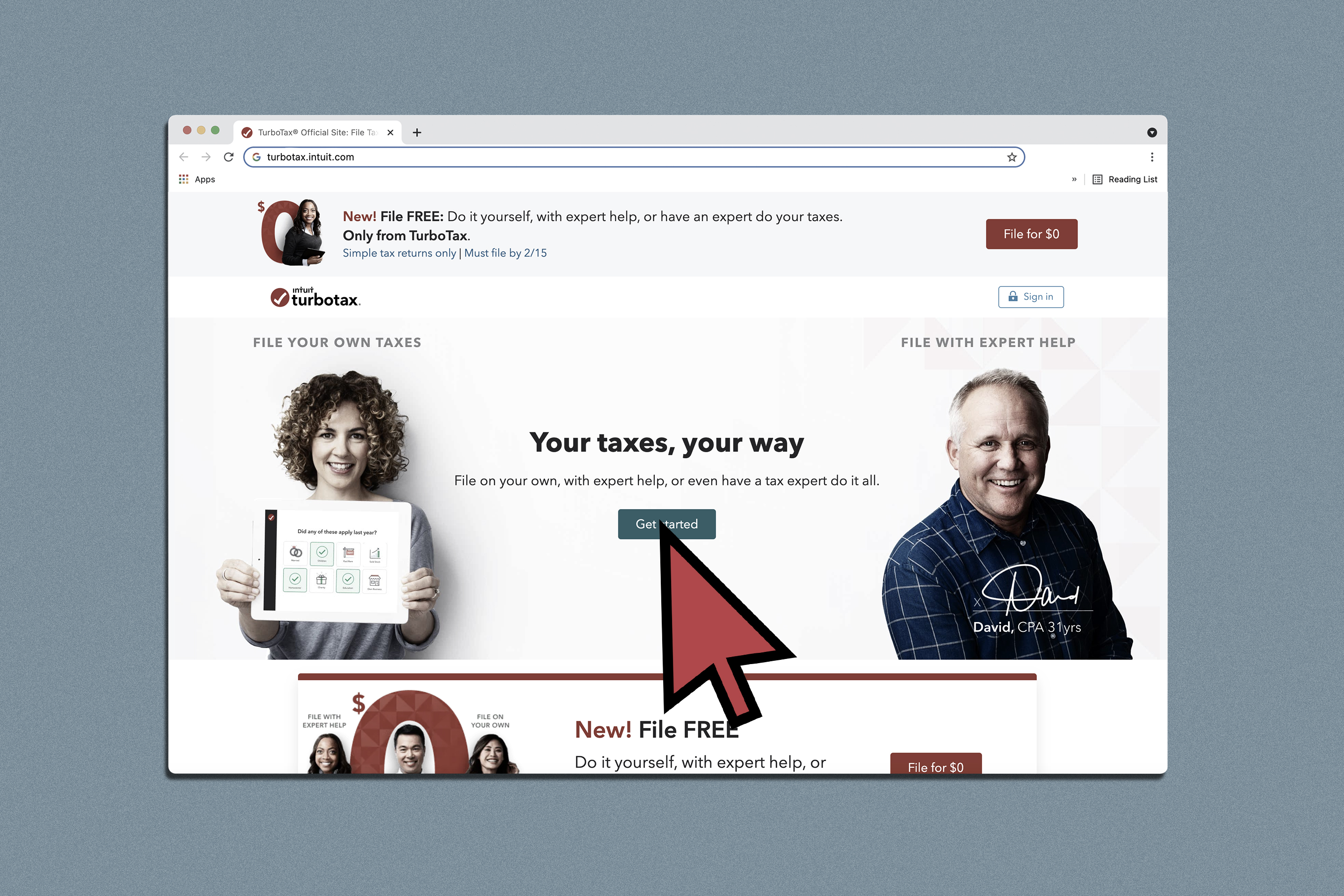

Unemployment Tax Refund Still Missing. Simply enter your information and the TurboTax e-File Status Lookup Tool gives you the status on your IRS federal tax return instantly. Choose the form you filed from the drop-down menu.

The IRS announced that you dont need to do anything right now to take advantage. No filed return means no tax refund. Early last month the IRS did release nearly three million refunds and said it.

1150 ET Aug 5 2021. Tax Return Access. You typically dont need to file an amended return in order to get this potential refund.

THE IRS is sending out more 10200 refunds to Americans who have filed unemployment taxes earlier this year. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5. If youre fine to file DIY the TurboTax Free Edition will be available the entire season according to a news release.

Enter the amount of the New York State refund you requested. How to Check Your Refund Status. TurboTax is always up to date with the latest tax changes.

Select the tax year for the refund status you want to check. TurboTax Live Full Service Basic in which a tax expert does your taxes for you is only free until Feb. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only.

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. 4 weeks after you mailed your return. In the Refund Date field enter the deposit date.

If you e-filed your tax return using TurboTax you can check your e-file status online to ensure it was accepted by the IRS. Youll also receive an e-mail confirmation directly from the IRS. Get your tax refund up to 5 days early.

When to expect your refund. When you file your federal income tax return on TurboTax youll get these automatically handled if. The American Rescue Plan makes the first 10200 of unemployment income tax-free for households with income less than 150000 for your 2020 taxes only.

The IRS has just started to send out those extra refunds and will continue to send them during the next several months. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. Enter your Social Security number.

Enter the amount from Schedule 1 lines 1 through 6. I filed my taxes with Turbotax and got them direct deposited back in March but with the CTC payments I am getting a check for some reason I was trying to figure out if my unemployment refund will be to the same bank as my tax refund or if im going to have to wait forrreevvveer for a. Go to the Employees menu and select Payroll Taxes and Liabilities and click Deposit Refund Liabilities.

Youll need to enter your Social Security number filing status and the exact whole dollar amount of your refund. For more information on your refund status please see this CRA link. Unemployment and Taxes Explained TurboTax Tax Tip Video.

Those who are due to receive the refund are taxpayers who filed for unemployment in 2020 but submitted their tax returns before Bidens American Rescue Plan was signed into law. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. If youve already filed your 2020 tax return dont worry.

Once payment has been received the product is considered to have been used to prepare your taxes regardless of whether you print or electronically file your return or if its rejected. If you are filing Form 1040 or 1040-SR enter the total of lines 1 through 7 of Form 1040 or 1040-SR. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of unemployment compensation paid in 2020.

TurboTax cannot track or predict. Get your tax refund up to 5 days early. You can usually expect your refund within two weeks after you successfully NETFILE but may take longer if your return is selected for a review.

If you are filing Form 1040-NR enter the total of lines 1a 1b and lines 2 through 7. You can also call the IRS to check on the status of your refund. However if you havent yet filed your tax return you should report this reduction in unemployment income on your Form 1040.

Online Account allows you to securely access more information about your individual account. You may be prompted to change your address online. Otherwise the IRS will mail a paper check to the address it has on hand.

You cannot check it. Line 7 is clearly labeled Unemployment compensation 4 The total amount from the Additional. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early.

Check My Refund Status. TurboTax Online can be used at no cost up until the point that you submit payment. Coronavirus Unemployment Benefits and Tax Relief.

The deadline to file your federal tax return was on May 17. You must file Schedule 1 with your Form 1040 or 1040-SR tax return. See Refund amount requested to learn how to locate this amount.

Instead the IRS will adjust the tax return youve already submitted. The free TurboTax Live Basic offer which comes with live on-demand expert help lasts through March 31. Submitting payment reflects your satisfaction with TurboTax Online preparation of.

Use the CRAs My Account. Check your refund status online 247. Select the name of the vendor who submitted the refund check.

In the For Period Beginning field enter the first day of the pay period that the refund affects. The refund will go out as a direct deposit if you provided bank account information on your 2020 tax return. Terms and conditions may vary and are subject to change without notice.

The unemployment tax break given to taxpayers who received unemployment compensation with a modified adjusted income of less than 150000 is eligible for up to 10200 tax break on this income earned. Check the e-file status of your federal tax refund and get the latest information on your federal tax return.

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensatio Internal Revenue Service Tax Refund Topics

How To File Taxes For Free Turbotax 2022 Free File Change Money

![]()

What You Need To Know About Unemployment Tax Refund Irs Payment Schedule And More

Where S My Tax Refund How To Check Your Refund Status Tax Refund Filing Taxes Tax

1040ez Google Search Financial Aid Tax Software Best Tax Software

How To Get A Refund For Taxes On Unemployment Benefits Solid State

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Checklist Of Info And Documents Needed For Taxes Click For Full Pdf Tax Preparation Turbotax How To Apply

How To Check Your Tax Refund Status Turbotax Tax Tips Videos

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

Turbotax Launches The Turbotax Unemployment Center The Turbotax Blog

Tax Refunds On 10 200 Of Unemployment Benefits Start In May Irs

Everything You Need To Know About The New Unemployment Benefits And Tax Relief Youtube

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

The Dollar S Decline In Global Reserves Fact Or Fiction In 2021 Filing Taxes Turbotax Hr Block